Small business units get wings

Students of Commerce and Business Studies understand that micro, small and medium enterprises (MSMEs) play a very important role in the Indian economy. In this blog, we bring to you a snapshot of this sector and the stimulus package that the Government of India announced for them.

For long, there has been a demand to rescue the 63 million business units that employ 12 crore people, the cry for help became louder after Covid-19.

The Indian govt. announced a Rs 3 lakh crore of collateral-free loans for small businesses and infused Rs 50,000 Cr equity. What does this mean? To put it in simple terms, the ailing MSME sector can now resume their business activity and safeguard jobs.

The MSME sector employs unskilled, semi-skilled and skilled labour. This sector accounts for a third of India’s manufacturing output and 45% exports.

Another far-reaching decision taken by the Government of India is the cap on global tenders upto Rs 200 Cr will be disallowed to help MSMEs get a share of the business.

The US govt. had announced a $484 billion stimulus package for their small businesses, the Indian Government’s decision in a way drew inspiration from it.

The credit guarantee by the government is ‘music to the ears’ for entrepreneurs. What this means is: Loans to banks will be paid by the Government in case the MSME falters. In the new scheme of things, if an MSME already has a loan with a bank but due to Covid-19 is in a crisis, it can take more loans, without any collateral, now the government will guarantee such loans fully.

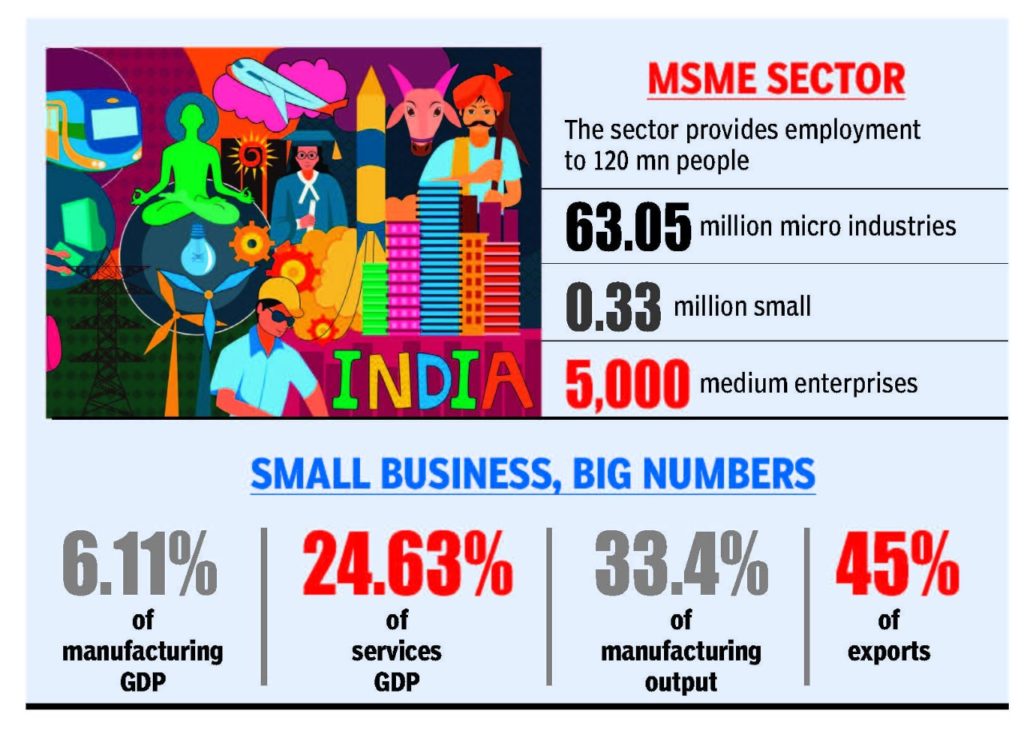

MSME SECTOR

- The sector provides employment to 120 mn people

- 63.05 million micro industries

- 0.33 million small

- 5,000 medium enterprises

Small business, big numbers

- 6.11% of manufacturing GDP

- 24.63% of services GDP

- 33.4% of manufacturing output

- 45% of exports